Why Biza?

Founded in 2017, we help organisations navigate the highly regulated CDR ecosystem, and innovate within the Australian data-sharing landscape.

Non-bank lenders are now centre stage as the third sector welcomed into the CDR family, following banks and energy retailers. As of March 3, 2025, the government officially opened the doors for non-bank lenders, empowering Australians and organisations to enjoy smoother, smarter, and more transparent financial interactions.

This next chapter in Open Banking is designed to shake up consumer lending by increasing competition, driving innovation, and sharpening the focus on high-value, widely available lending products. Plus, Buy Now, Pay Later products are now also part of the ecosystem.

Greater access to non-bank lending data is fuelling fintech breakthroughs and giving consumers the clarity they need to master their money.

NBL Obligations Timeline

13th July 2026

9th November 2026

9th November 2026

10th May 2027

We'll take the stress out of the CDR

days

hours

minutes

seconds

With the Tranche 1 compliance deadline rapidly approaching, it's time to act. Read on below to find out about Product Manager's features or watch a short demo video.

Ready to get started? Sign up for a free Product Manager Starter account and experience the benefits first hand.

Biza's Data Holder as a Service (HaaS) helps non-bank lenders meet their CDR obligations and maintain data quality with a comprehensive, cost-effective solution.

Complete technical implementation with FAPI compliance and robust security protocols to meet all regulatory requirements.

Comprehensive product information database complete with a simple administration console, ensuring accurate and up-to-date product details for compliance.

Full account management capabilities including joint accounts, business accounts, vulnerable users, secondary user instructions and nominated representatives.

User-friendly interface for consumers to manage their data sharing preferences and view consent history.

Seamless integration with existing banking systems and infrastructure for smooth deployment and operations.

Real-time monitoring, reporting capabilities, and administrative APIs for complete system oversight and management.

Founded in 2017, we help organisations navigate the highly regulated CDR ecosystem, and innovate within the Australian data-sharing landscape.

We support more CDR Data Holders than anyone else, providing unrivalled experience and reliability. We're trusted by Australia's leading banks, energy providers and non-bank lenders.

We're uniquely positioned to operate on both sides of the CDR ecosystem as both a Holder and Recipient delivery partner.

We're passionate data geeks, constantly pushing boundaries to deliver practical, future-ready solutions that turn visionary ideas into real business advantage and empowered consumers.

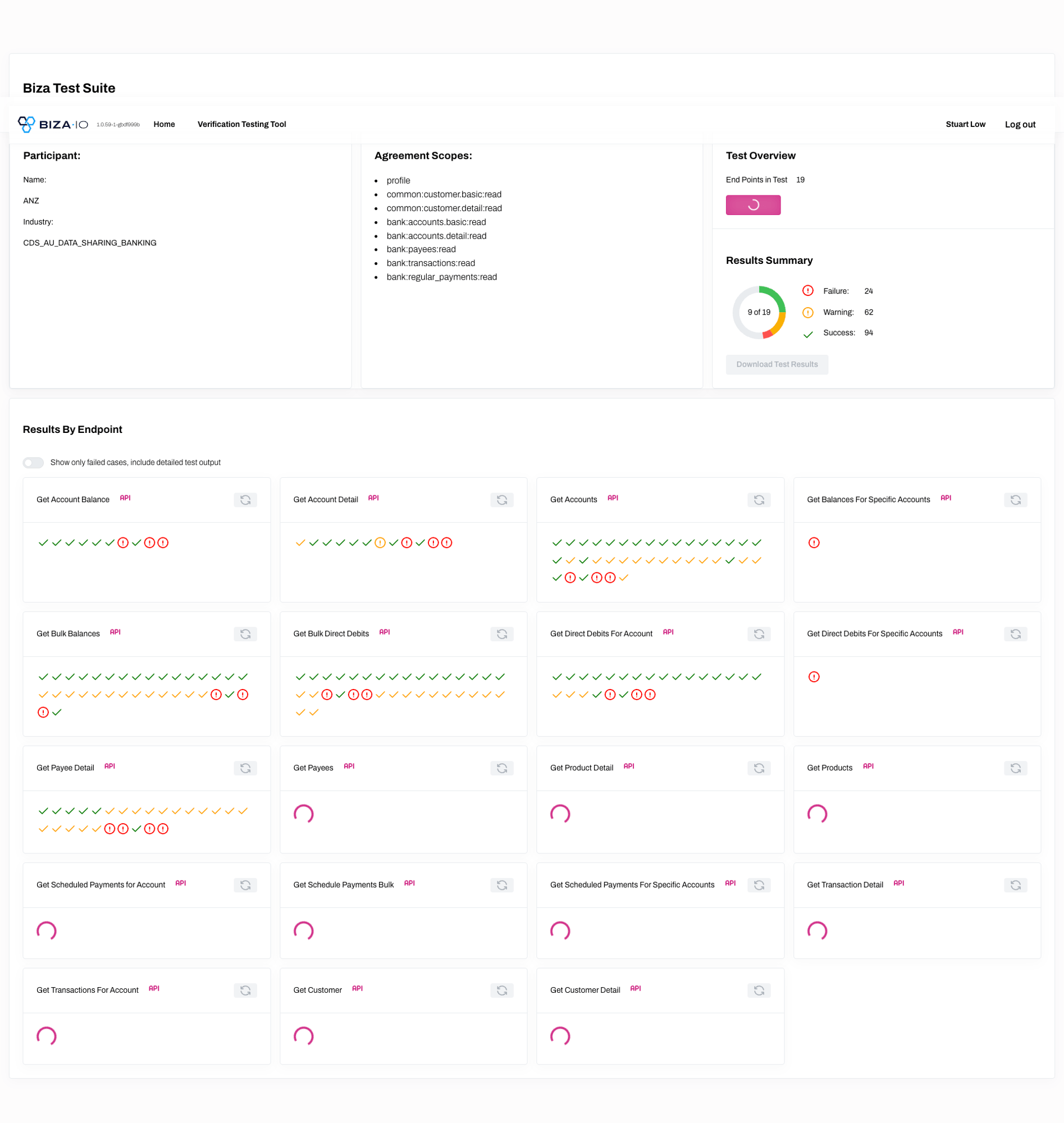

Biza's Verification Test Suite (VTS) is a market-leading, ACCC-aligned playground where Data Holders and Data Recipients can trial their solutions end-to-end. Go beyond guesswork and enjoy complete confidence in your CDR compliance before hitting 'go-live'.

Biza’s Product Manager empowers banks and non-bank lenders to publish and maintain accurate Product Reference Data, ensuring you stay confidently on the right side of regulation.

Stay effortlessly ahead of your CDR Product Reference Data obligations with a sleek, intuitive interface designed for compliance.

Unlock secure, seamless CDR compliance with our HaaS for Banking solution. Effortlessly share product reference data, manage consumer consents through an intuitive dashboard, and support joint and business accounts, right out of the box. Biza's platform integrates smoothly with your enterprise systems, while delivering robust InfoSec controls, actionable service metrics, and powerful admin APIs.

We have the largest number of CDR experts under one roof.

Our Holders seamlessly deliver Consumer Data 24/7, 365 Days Per Year.

Backed by ISO27001, SOC2, ASAE3150 certifications.

We know how to deliver into the CDR ecosystem.

Let us be your guide through the twists and turns of the CDR landscape.