Why Biza?

Founded in 2017, we help organisations navigate the highly regulated CDR ecosystem, and innovate within the Australian data-sharing landscape.

.png)

Designed and overseen by the Australian federal government, the Consumer Data Right (CDR) is a transformative economic reform. It empowers consumers to securely control and share their financial and energy data.

The CDR drives innovation and competition, enabling businesses to offer personalised services with strong security and privacy. Banking and energy are already live in the ecosystem, and non-bank lending is next starting in 2026.

For forward-thinking organisations, CDR compliance unlocks new revenue, enhances customer experiences, and builds a competitive advantage.

Our Holder as a Service (HaaS) platform eliminates CDR complexity for mandated data holders. Get rapid, cost-effective implementation, covering everything from APIs to consumer dashboards, all with bank-grade security and scalability.

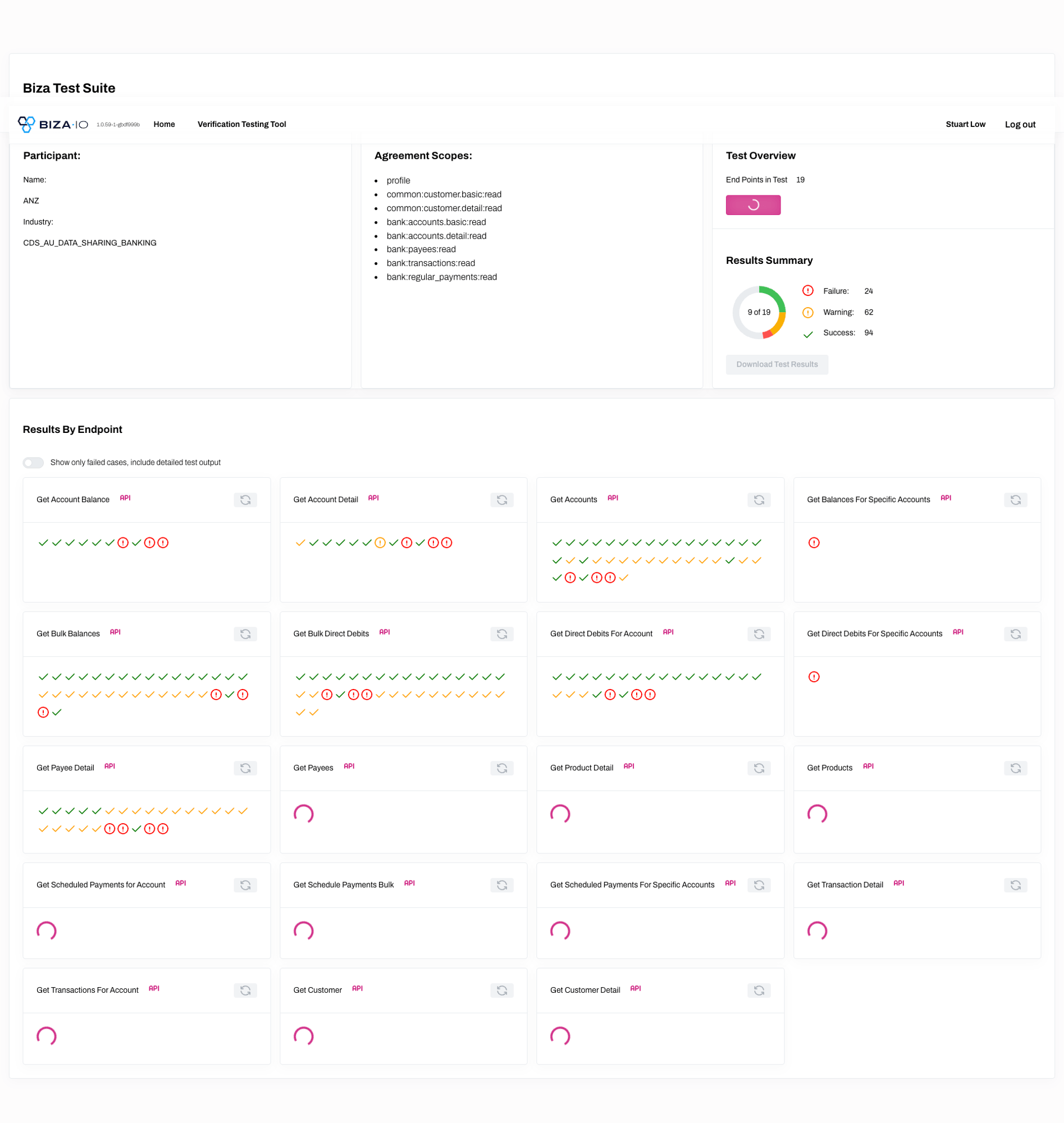

Securely access consumer data with our battle-tested platform. Our Open Gateway and Verification Test Suite empower you to build innovative financial or energy products faster. Retain control while leveraging Biza's expertise for swift market entry and assured compliance.

Founded in 2017, we help organisations navigate the highly regulated CDR ecosystem, and innovate within the Australian data-sharing landscape.

We support more CDR Data Holders than anyone else, providing unrivalled experience and reliability. We're trusted by Australia's leading banks, energy providers and non-bank lenders.

We're uniquely positioned to operate on both sides of the CDR ecosystem as both a Holder and Recipient delivery partner.

We're passionate data geeks, constantly pushing boundaries to deliver practical, future-ready solutions that turn visionary ideas into real business advantage and empowered consumers.

Biza's Verification Test Suite (VTS) is a market-leading, ACCC-aligned playground where Data Holders and Data Recipients can trial their solutions end-to-end. Go beyond guesswork and enjoy complete confidence in your CDR compliance before hitting 'go-live'.

Biza’s Product Manager empowers banks and non-bank lenders to publish and maintain accurate Product Reference Data, ensuring you stay confidently on the right side of regulation.

Stay effortlessly ahead of your CDR Product Reference Data obligations with a sleek, intuitive interface designed for compliance.

Non-bank lenders have officially joined the Open Banking evolution as the third sector empowered by the Consumer Data Right, following in the footsteps of banks and energy retailers.

As of March 3, 2025, the government brought non-bank lenders into the CDR fold, unlocking smarter, more transparent data sharing for both consumers and organisations. It will provide greater choice, clearer insights, and stronger financial outcomes for millions of Australians.

In June 2023, we launched DataRight Plus, a community project introducing enhancements and new features to the CDR ecosystem beyond the current government mandate.

We're inviting technical implementers in both data holder and recipient spaces to collaborate and expand capabilities beyond CDR obligations. Join our growing community of innovators shaping the future of data sharing in Australia

jbooth@biza.io: Mar 11, 2025

jbooth@biza.io: Mar 3, 2025

wstuart@biza.io: Aug 24, 2024

Join Australia's most innovative organisations in transforming consumer data sharing. Our CDR specialists are ready to design a solution that meets your unique requirements whilst ensuring full regulatory compliance.

Book a consultation today and discover how Biza can accelerate your CDR journey from compliance to competitive advantage. Our team of experts will assess your requirements and provide a customised roadmap for success.